This year’s Wellington Regional Report reflects what our Wellington Regional Manager Ben Stevenson has dubbed a ‘dynamic’ 2022 in the tech sector, with plenty of feedback around the difficulty of filling roles and the motivations of both tech employees and employers.

In this blog we’ll share some of the insights we gleaned from our report. We encourage you to read the full report too, as knowledge about the local industry can be a valuable resource for tech employers and IT professionals alike – especially if you’re hiring or looking for a new tech role!

- Download the Wellington Job Market Report

About the respondents

To give you an idea of where the data came from, here’s a breakdown.

The Wellington Regional Report tech professional respondents were made up of 69% male, 29% female, 1% non-binary and 1% prefer not to say. The type of employment our IT professional respondents came from was made up of 50% permanent, 43% contract and 7% fixed term. 98% work full time. In terms of time spent in their current role, 59% advised less than a year, 25% 1-3 years, 5% 3-5 years and 11% in their role for 5 years or more.

The tech employers surveyed were made up of 60% public sector, 33% private sector and 7% Not-for-profit/social enterprise. In terms of the size of their IT staff, 44% of our employers employed over 151 tech professionals. The breakdown on company size was 35% Enterprise (2,001+ people), 31% Large (251-2,000) people, 27% Medium (51-250 people) and 7% small (up to 50 people).

Current hiring intentions by tech employers

It’s no secret that the New Zealand tech sector has had challenges with finding enough candidates for a rapidly expanding and varied industry, and the events of the past few years have only served to worsen this imbalance of demand to supply.

We’re now facing a different kind of challenge. On one hand, the borders reopening means there’s a lot more overseas talent available, helping to fill niche, specialised, and high-level roles. On the other hand, many Kiwi tech professionals (especially those in the early stages of their career) are leaving to pursue overseas opportunities. Luckily this seems to be less common in the Wellington region, with 12% of tech professionals considering a move overseas this year, compared to 58% nationally.

In our pool of tech employers,

- 80% of respondents planned on recruiting permanent staff this year

- 68% of that group planned on hiring three or more new permanent team members

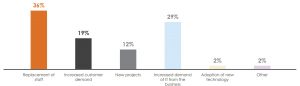

When we talked to our tech employers about their motivators for hiring, the breakdown of main reasons was as follows:

Replacement of staff represents the dynamic market in which roles advertised are in hot competition with each other and professionals can unlock higher remuneration with strategic moves to other companies. In our research and first-hand experience as IT recruiters, we’ve observed that this year new roles are appearing almost as soon as existing roles were filled – reflective of the competitive nature of the market and net lack of professionals needed to meet every employer’s resourcing needs.

The importance of contractors

The tech sector, thanks to its high number of projects and requirements for very specialised skill sets, is naturally an industry with a healthy portion of contract workers – as mentioned earlier, 43% of our tech professional respondents were currently working in a contract role.

When we talked with employers about their contractor needs, they provided 3 main reasons why they specifically looked for contractors. First, the aforementioned requirement for project resource – a finite period of time where the budget to resource balance needs to be managed closely and full-time staff are often preoccupied with ‘BAU’ work.

Second is skill availability – not many businesses have tech teams big enough to cover all specialised skill sets in the industry, and even the most seasoned IT professionals rarely hold advanced skill sets across all disciplines. So when businesses require a specific talent to meet the needs of their project or transformation, they often turn to contractors who have the required skills.

Third is the age-old challenge of finding budget from the appropriate cost centre and expenditure source – commonly referred to as capital expenditure (CapEx) vs. operating expenses (OpEx). Projects and programmes generally have a distinct budget and represent an ‘investment’ the business is making to evolve or improve the organisation in a certain way. Therefore, much of a project’s resource will come from the capital expenditure side – this includes contractors. Operating expenditure is typically more rigid, long term, and reflects the day-to-day operations as opposed to one-off investments.

IT skills most in demand in Wellington

Nearly all tech skills are in demand due to the shortage of people and abundance of resourcing needs across all sizes of business. However, the Wellington Regional Report research did provide us with those skills most in demand.

Business Analysis

Interestingly, the most in-demand skill from employers wasn’t a ‘technical’ IT discipline but rather BA roles with knowledge/application in IT. Business analysis is crucial for the public sector and large enterprise to properly understand the requirements of a project, programme or other investment. Building a business case, particularly in the public sector, is subject to meticulous research and planning, underpinned by frameworks like Treasury’s Better Business Cases™ (BBC). Employers are finding a shortage of experienced business analysts that can take the strategic and operational objectives of a project and translate these into technical and project requirements.

Software Developers

A discipline that’s been in shortage since Absolute IT started in 2000, Wellington employers are still experiencing a shortage of talented software developers that can apply their skill sets to a variety of business challenges and projects. In Wellington, software developers will find opportunities in the public sector making our country’s various functions run better, helping build and evolve products within the SaaS/tech private sector, working within development teams in large enterprise businesses, and working for numerous projects and clients in the varied world of development agencies.

DevOps

Ensuring the operation and infrastructure of day to day systems is compliant, secure, and performant is something that virtually every organisation needs to prioritise. In Wellington’s busy public and private sectors, DevOps teams and individuals are in high demand, with the expectation that systems, networks and other functions are continually tested and evolved.

Architecture

A discipline of IT that’s the domain of highly experienced tech professionals, solutions architecture is high stakes work that Wellington employers are struggling to resource effectively. Anyone with project experience and demonstrable skills in this space should find interesting work in projects and programmes. If you’re interested in finding high earning, interesting work in this space, we want to hear from you.

Remuneration and bonuses

While this latest Regional Report doesn’t cover salary in detail like our IT Job Market & Remuneration Report, it does cover the topic of pay increases and bonuses.

Through the responses we learnt that 88% of Wellington tech employers gave their team pay increases; an indication of the highly competitive market and a desire to reduce staff attrition in these key areas. Interestingly, this is somewhat lower than Auckland, where 94% of employers gave their staff a pay increase. Also, when surveying our tech professionals, their expectations for pay increases didn’t reflect the proactive nature of employers:

Bonuses were less common than pay increases in Wellington with only 12% getting a bonus while 47% didn’t, with the remaining 41% ineligible. This likely reflects the strong public sector representation in the capital, where bonuses are not part of typical employment agreements.

Workplace satisfaction of Welli tech professionals

Workplace satisfaction and culture is a massive part of the tech industry’s ability to retain good talent. Our research showed that 9/10 of Wellington tech professionals consider their current organisation a good place to work. The reasons for this satisfaction varied, but the most common factors were workplace culture (33%) and interesting/satisfying work (26%).

Despite this, 6/10 of our tech professional respondents were still considering a move to a new workplace this year. However, this seems to be reflective of the high number of contractors who responded, as the most common reason for considering a move was due to a project or contract ending; though career development and improved salary/remuneration were also factors.

As expected, the main factor that tech professionals said would influence them to actually accept a job offer was improved salary, with challenging work and flexibility being the other main deciding factors.

The era of remote working

Remote working has evolved from being a novelty to a part of everyday life for a lot of people. The work-life balance obtained from being able to work from home or on the go is now considered the most important benefit for Wellington tech professionals. We expect this to be a permanent paradigm shift from pre-COVID work practices of being in the office most of the week.

Of our employers surveyed, 81% have remote workers, while 98% of tech professionals are offered flexible work options – the industry is adapting to the changes brought about through necessity since 2020.

Remote working takes a number of forms in different organisations. 9% of respondents who work remotely do so entirely. 88% mix working remotely and coming to the office which brings many benefits such as team interaction, communication, while still providing solitude for focusing on big pieces of work. 3% had an arrangement outside of these two common practices.

Intern/grad programmes still a popular foot in the door

Absolute IT are big advocates for employers offering internships and graduate programmes, helping to bridge the gap between students, grads and juniors and the industry opportunities they want to get into. With such a shortage of talent in New Zealand for the tech sector, internships are wonderful programmes to harness raw potential and foster growth in a real environment. When we asked the 21% of tech professionals who’d gone through an internship or graduate program, we learned that 96% found this role extremely or very valuable to their IT career.

Top tech trends according to the Welli market

Part of being a well-rounded tech professional or organisation is keeping up with the latest developments in technology and innovation. We asked both tech professionals and tech employers what they believed the biggest impacts to the sector will be in the coming year. Both groups cited artificial intelligence as the single most impactful trend that will impact the sector and potentially the job market.

Job seekers should take from this a big opportunity to develop their skills and knowledge in the AI space, which will be applied to more and more projects and roles in the coming years.

More about New Zealand’s IT industry

If you’re interested in reading more about our tech sector, head over to the Absolute IT blog where you can find insights about a range of topics including skills in demand, pay and evolving technologies.

Explore our current Wellington IT roles today

Are you looking for a new IT role, perhaps one in which you can enjoy a flexible working arrangement? Check out our latest jobs to potentially find your next big career move, or get in touch today!

- View the Wellington Regional report here.